Manage a pool

This guide outlines how to manage a pool on the Centrifuge protocol.

Price updates

Each pool on the Centrifuge protocol can have multiple share classes. The price of each share token must be maintained and updated to reflect its current value. This price is managed at the protocol level through the Hub contract.

To update the token price for a specific share class in a pool, call the following function on the Hub:

hub.updateSharePrice(poolId, scId, sharePrice, uint64(block.timestamp));

poolId: the unique identifier of the poolscId: the identifier of the share class within the poolsharePrice: the new price of the share token (18 decimal fixed point integer)uint64(block.timestamp): timestamp when the price was computed

Currently, the pricing mechanism is intended to be provided by an off-chain computation. In the future, on-chain price calculations will be implemented, using the holdings and double-entry bookkeeping accounting mechanism of the Hub.

Pushing to price oracles

After updating the share token price, it must be pushed to the price oracle on each deployed network. This ensures that other contracts and off-chain components can retrieve the latest share price.

To notify the price oracle, call the following function:

hub.notifySharePrice{value: gas}(poolId, scId, centrifugeId, msg.sender);

poolId: the identifier of the pool whose share price was updatedscId: the share class identifier for which the price was updatedcentrifugeId: the network identifier where the oracle should receive the updated pricegas: The amount of native currency to cover cross-chain messaging costs (excess will be refunded)msg.sender: Address to receive any excess gas refund

Updating and pushing asset prices

Since multiple assets can be used to invest in the same pool, the price of the asset denominated in the currency of the pool (e.g. USD) also needs to be set.

By default, this price is assumed to be 1.0, implying a 1-to-1 peg between all assets.

This needs to be pushed to the asset price oracle on each network once:

hub.notifyAssetPrice{value: gas}(poolId, scId, assetId, msg.sender);

gas: The amount of native currency to cover cross-chain messaging costs (excess will be refunded)msg.sender: Address to receive any excess gas refund

Managing investment requests

Investment requests, whether deposits or redemptions, are submitted by users through vaults operating on various chains. Despite being initiated on different networks, these requests are managed centrally on the Hub chain. This ensures consistent processing and coordination across the entire protocol.

Each request is tracked in a central contract called the BatchRequestManager.

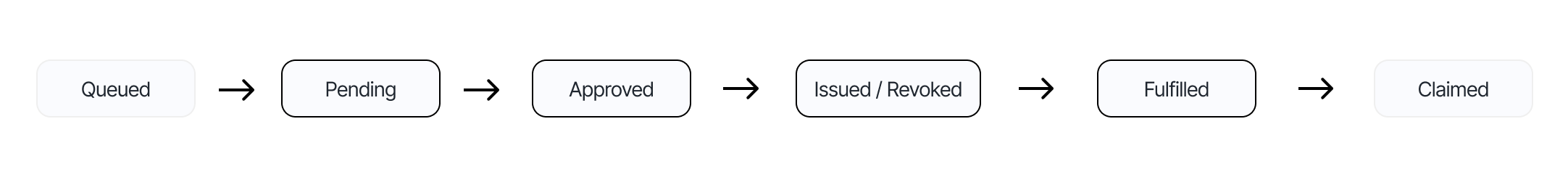

Lifecycle of a request

Deposit and redeem requests move through six stages:

- Queued: An optional stage that requests go through if there was non-zero approved or issued/revoked but not yet fulfilled requests for this user.

- Pending: The initial state after submission by the user. The request has not yet been approved.

- Approved: The Hub manager approves the request. For deposits, this allows Balance Sheet Managers to withdraw the requested assets and allocate them as needed. At this stage, the request is not yet priced. The request can not be cancelled anymore once approved.

- Issued/revoked: A share price is assigned. For deposits, shares are issued to the user; for redemptions, shares are revoked in return for assets.

- Fulfilled: The corresponding vault is informed that the request has been processed. The user can now claim their shares (for deposits) or assets (for redemptions).

- Claimed: The user has successfully claimed their resulting assets or shares.

The separation of approval and issuance/revocation is to be used for cases where the price of the execution depends on buying or selling underlying assets, which can only happen after the request is fulfilled and the assets can be withdrawn and the request cannot be cancelled anymore.

For synchronous deposit vaults using ERC-4626, asset deposits skip all six stages, and shares are immediately minted into the user's wallet.

Request batching and partial fulfillment

The BatchRequestManager maintains First-In-First-Out (FIFO) batch-based logic for all pending requests. Batches are created when the fund manager triggers an approval, all requests that are pending at that moment become part of that batch. When a batch is approved with a specific total amount, the BatchRequestManager processes all requests in that batch. If the approved amount is insufficient to fulfill all requests in the batch, each request is fulfilled proportionally based on its share of the total requested amount.

As an example, consider three deposit requests submitted in this order:

- User A requests 10 shares

- User B requests 5 shares

- User A requests another 10 shares

Case 1: Approving after each request

If the fund manager approves 15 shares after the second request is submitted:

- Batch 1 (requests 1-2, approved for 15 shares):

- First request (User A, 10 shares): Fully approved ✓

- Second request (User B, 5 shares): Fully approved ✓

Then if the fund manager approves 5 shares after the third request:

- Batch 2 (request 3, approved for 5 shares):

- Third request (User A, 10 shares): Partially approved for 5 shares

After both batches:

- User A has 10 shares fully approved from first request, and 5 shares partially approved from second request

- User B has 5 shares fully approved

Case 2: Approving after all three requests

If the fund manager waits and approves 20 shares only after all three requests are submitted:

- Batch 1 (requests 1-3, approved for 20 shares total out of 25 requested):

- First request (User A, 10 shares): Partially approved for 8 shares (10 / 25 × 20 = 8)

- Second request (User B, 5 shares): Partially approved for 4 shares (5 / 25 × 20 = 4)

- Third request (User A, 10 shares): Partially approved for 8 shares (10 / 25 × 20 = 8)

After this batch:

- User A has 8 shares approved from first request and 8 shares approved from second request (16 total)

- User B has 4 shares approved

This batch-based FIFO approach ensures fair and predictable processing across all investors, with the timing of approvals determining which requests are grouped together for processing.

Approving a request

Once a request is pending, the Hub manager must approve it. This is done by calling the appropriate function on the BatchRequestManager:

batchRequestManager.approveDeposits{value: gas}(poolId, scId, assetId, batchRequestManager.nowDepositEpoch(poolId, scId, assetId), approvedAssetAmount, pricePoolPerAsset, msg.sender);

batchRequestManager.approveRedeems{value: gas}(poolId, scId, assetId, batchRequestManager.nowRedeemEpoch(poolId, scId, assetId), approvedShareAmount, pricePoolPerAsset);

approvedAssetAmount/approvedShareAmount: The total amount being approved for this batchpricePoolPerAsset: The price of the asset denominated in the pool currency (18 decimal fixed point integer)gas: The amount of native currency to cover cross-chain messaging costs (excess will be refunded)msg.sender: Address to receive any excess gas refund (deposits only)

Approving a deposit allows any authorized Balance Sheet Manager to withdraw the approved amount of assets. These assets can be invested before the share price is determined.

Issuing or revoking shares

After approval, the next step is to finalize the share price and process the request. This is done by issuing shares (for deposits) or revoking shares (for redemptions):

batchRequestManager.issueShares{value: gas}(poolId, scId, assetId, batchRequestManager.nowIssueEpoch(poolId, scId, assetId), pricePoolPerShare, extraGasLimit, msg.sender);

batchRequestManager.revokeShares{value: gas}(poolId, scId, assetId, batchRequestManager.nowRevokeEpoch(poolId, scId, assetId), pricePoolPerShare, extraGasLimit, msg.sender);

pricePoolPerShare: The share price in pool currency (18 decimal fixed point integer)extraGasLimit: Additional gas limit for cross-chain message execution (uint128, can usually be set to 0)gas: The amount of native currency to cover cross-chain messaging costs (excess will be refunded)msg.sender: Address to receive any excess gas refund

This step locks in the value of the transaction by applying the calculated share price.

Notifying vaults for fulfillment

Once shares are issued or revoked, each vault must be notified so that individual users can claim their resulting assets or shares. This is done per user using the following calls:

uint32 maxClaims = batchRequestManager.maxDepositClaims(poolId, scId, bytes32(bytes20(user)), assetId);

hub.notifyDeposit(poolId, scId, assetId, bytes32(bytes20(user)), maxClaims);

uint32 maxClaims = batchRequestManager.maxRedeemClaims(poolId, scId, bytes32(bytes20(user)), assetId);

hub.notifyRedeem(poolId, scId, assetId, bytes32(bytes20(user)), maxClaims)

After this, the request is marked as fulfilled, and the user can proceed to claim.