Issuers

This guide helps issuers tokenize real-world assets (RWA) using Centrifuge's RWA Launchpad. It walks through the end-to-end process of launching an asset-backed issuance, from setup to deployment.

Overview

The RWA Launchpad is a modular suite of institutional-grade smart contracts for launching tokenized financial products. Issuers can configure asset types, fund structures, and operational logic without writing custom code.

Supported use cases include:

- Tokenized bonds, equity, credit, real estate, and indices

- Fund structures like single-fund, fund-of-funds, or structured credit

- Operational logic such as on/off-ramping, fee distribution, waterfalls, and performance reporting

Issuance workflow

1. Configure your product

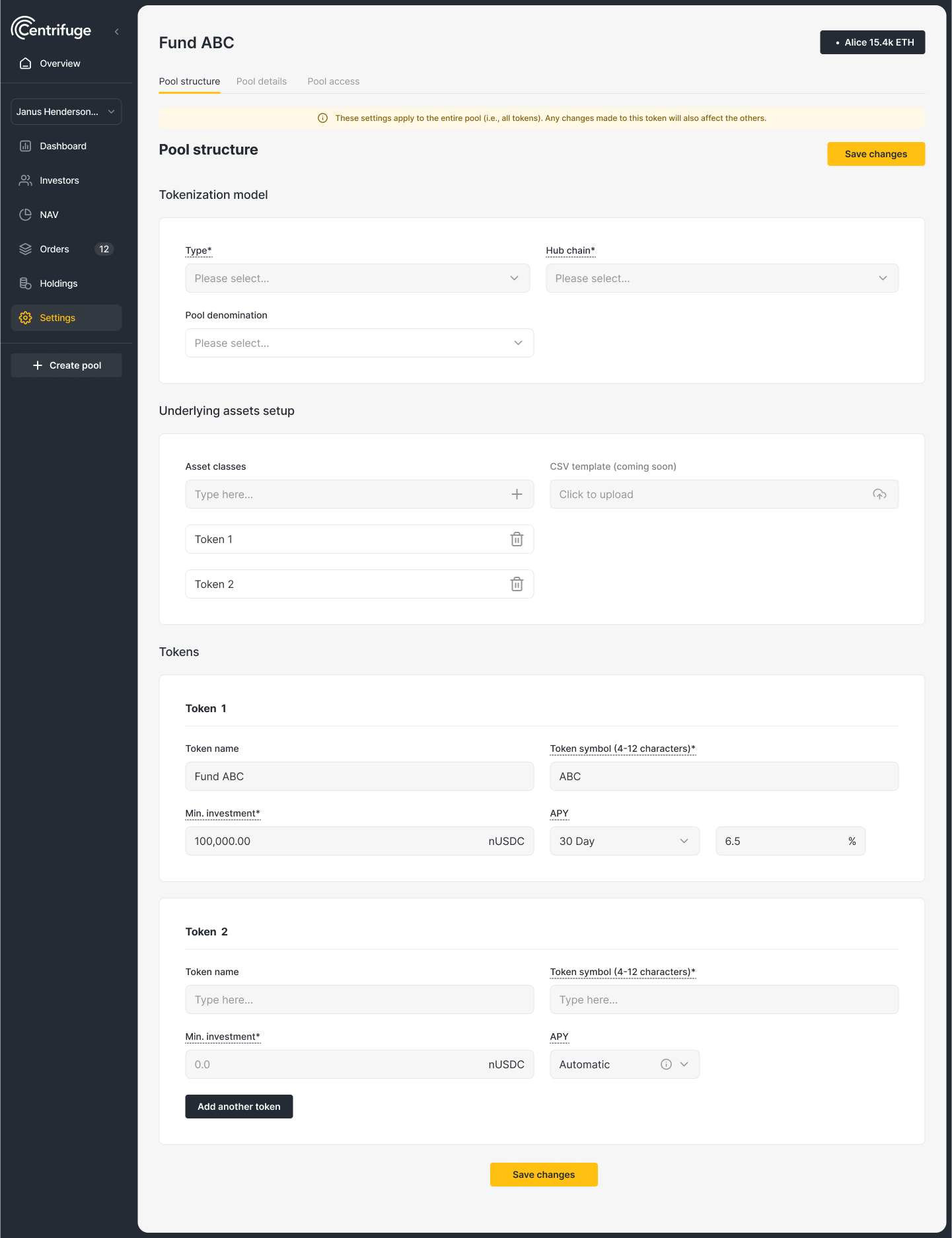

Use the Launchpad interface to configure:

- All pool details (type, issuer info, providers, ratings etc)

Show pool details UI

- Asset type (e.g. bond, equity, real estate)

- Share class structure (e.g. junior/senior tranches)

Asset type & Share class structure UI

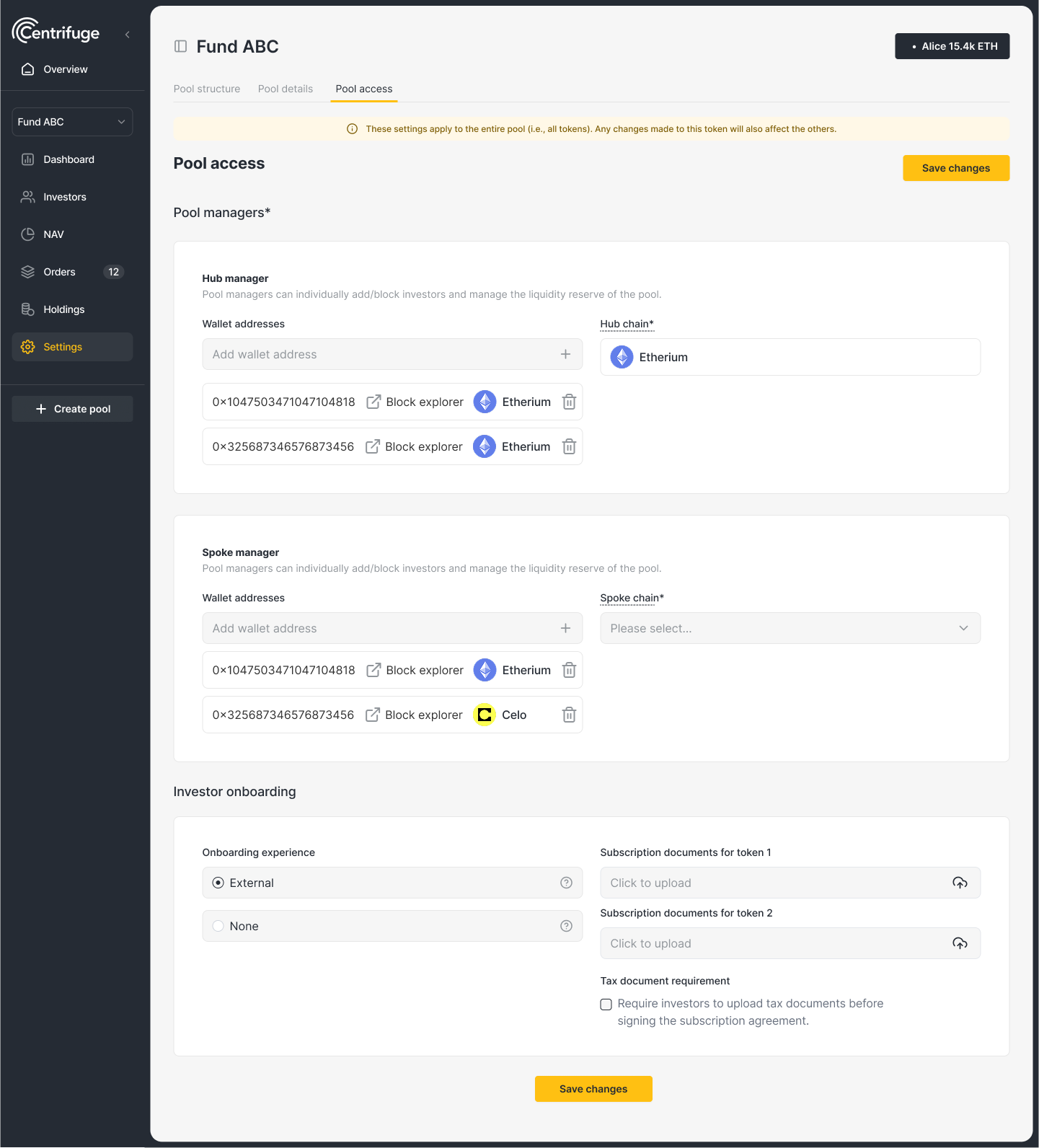

- Compliance rules (e.g. allowlist, jurisdictional controls)

- Manager access controls

Access Control UI

2. Deploy your pool

Launchpad deploys a suite of protocol-native contracts:

- ERC-20 share tokens with optional ERC-1404 restrictions

- Vaults using ERC-4626 (for synchronous deposits) or ERC-7540 (for asynchronous flows)

- Pooled vaults using ERC-7575 to aggregate capital across supported assets

- On/Off Ramp Manager to control asset movements

- Fee, accounting, and reporting modules

All contracts are upgrade-free and immutable once deployed.

3. Set up on/off-ramping

Configure on-chain and off-chain capital flows:

- Onramp: any user can deposit approved ERC20 tokens into the pool

- Offramp: only authorized relayers can initiate withdrawals to predefined recipient addresses

This ensures compliance and control over fund flows.

4. Launch your issuance

Once contracts are deployed and configured:

- Begin accepting deposits from whitelisted or open users (based on your setup)

- Mint and distribute share tokens

- Fund vaults with capital or asset-backed flows

Deposits and redemptions will follow the configured vault logic:

- Synchronous deposits: users receive shares immediately (ERC-4626)

- Asynchronous redemptions: requests are queued and processed via the Hub (ERC-7540)

Vault logic

Centrifuge supports two primary vault configurations:

-

Asynchronous vaults (ERC-7540)

Deposits and redemptions are request-based, coordinated through the Hub. This is ideal for RWAs with delayed settlement or valuation updates. -

Synchronous deposit vaults

Deposits are executed immediately using ERC-4626. Redemptions are still handled asynchronously via ERC-7540. This is ideal for liquid, onchain assets.

Each share token can be backed by multiple vaults—each accepting a different asset—using the ERC-7575 standard. This allows issuers to consolidate liquidity across asset types while managing them independently.

Post-launch operations

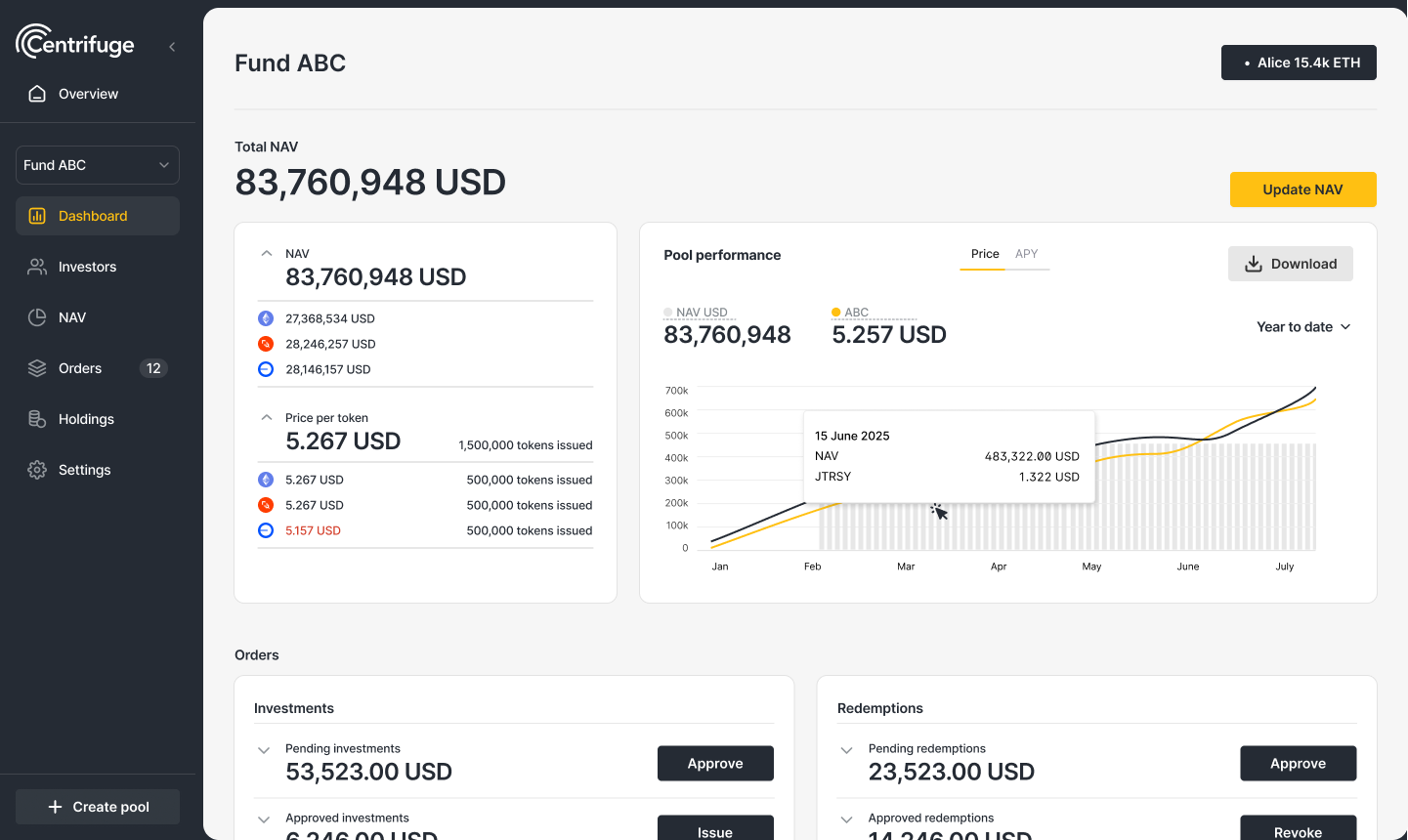

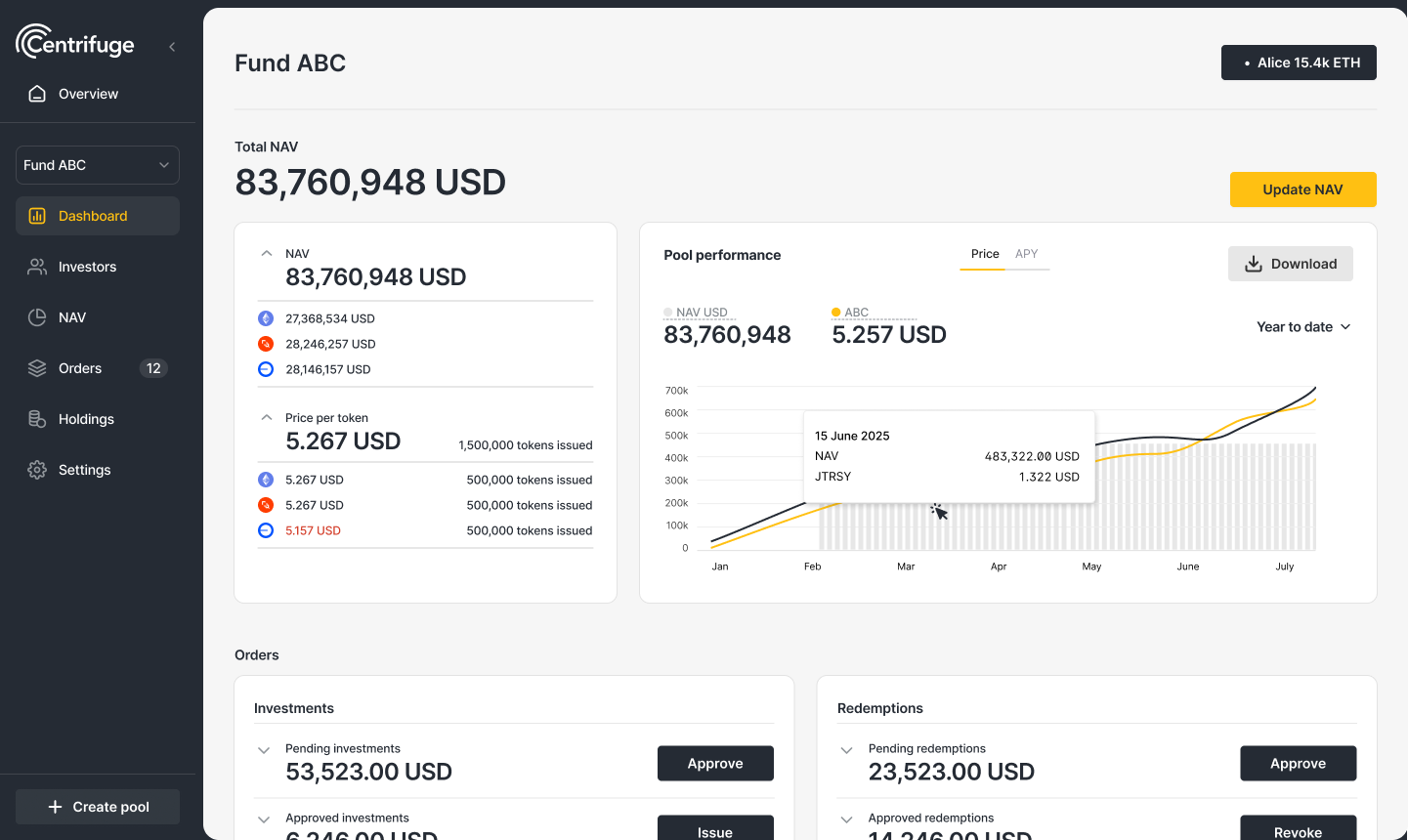

Track the performance and operations of your issuance:

- Issuer Dashboard

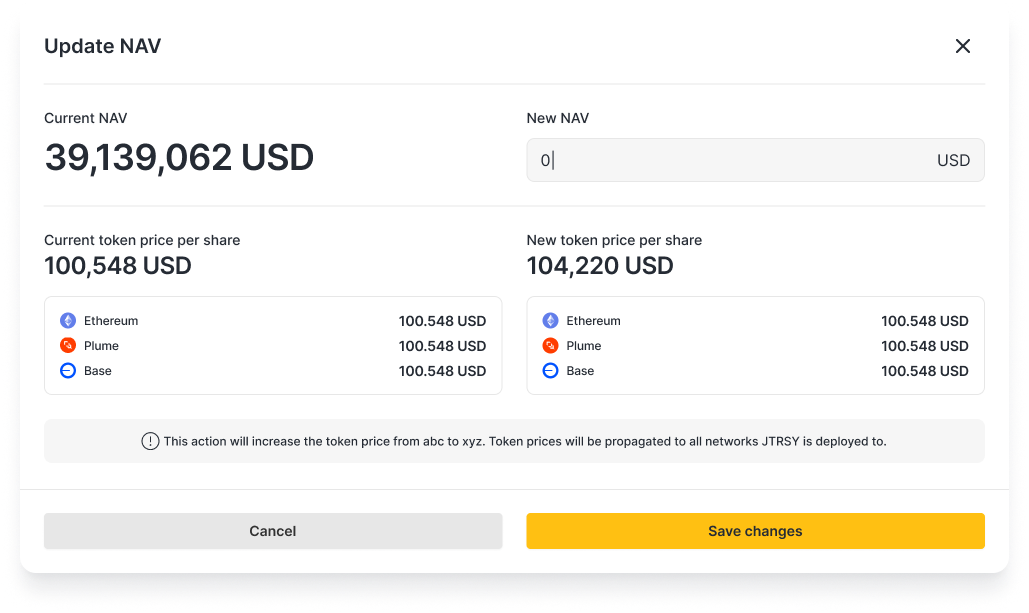

- Live reporting on NAV, share price, and token supply

Extensibility

Launchpad products are fully modular. Issuers can integrate:

- Custom relayers and compliance agents

- Fee structures and waterfall models

- Automated yield strategies

- Interoperability with DeFi protocols

Benefits for issuers

- Fast time to market: Launch in days, not months

- Secure and immutable: Smart contracts are non-upgradeable and decentralized

- Composability: Plug into the broader DeFi ecosystem

- Customizability: Tailor every aspect of your product to fit your asset and investor needs